Over the past ten days, Pi Network has shown a notable resurgence, rebounding sharply as the broader cryptocurrency market finds stability and investors look to capitalize on lower prices. The price of Pi coin, known for its viral tap-to-earn model, surged to a peak of $0.755 on Monday — its highest point since March 29. This marks a significant 92% increase from its lowest value this year.

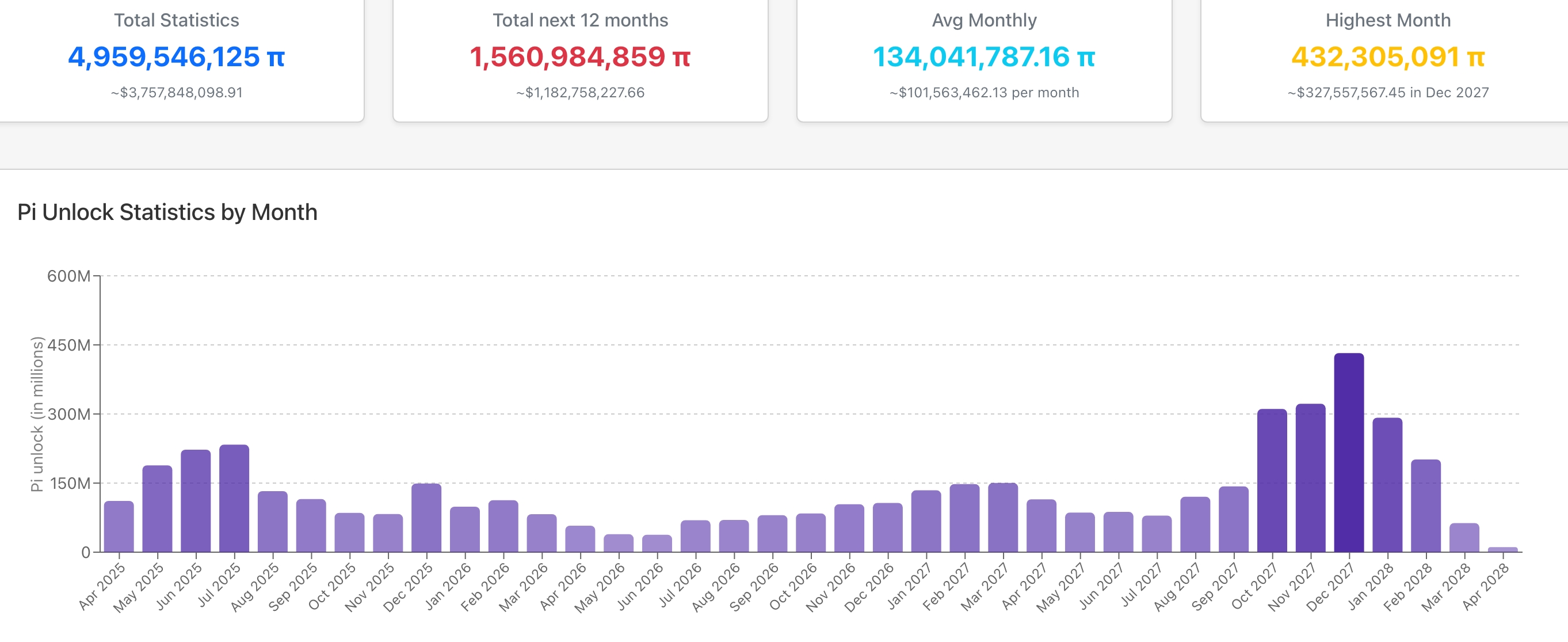

Prior to this recovery, Pi coin had been in a steep decline. Many early adopters, referred to as “Pioneers” — users who mined the coin before the launch of its mainnet in April — began selling off their holdings. This wave of selling, combined with the lack of listings on major centralized exchanges and growing concerns about token dilution, contributed to the bearish trend. A major point of concern remains the upcoming release of over 1.56 billion tokens within the next year, a move that could significantly dilute the coin’s value.

The recent bounce in Pi’s price coincides with Bitcoin’s strong performance, as the leading cryptocurrency continues to hold firm above the $80,000 mark, even amid a turbulent stock market and declining sentiment reflected in the Fear & Greed Index. Technical analysis of Pi’s four-hour chart shows a breakout from a falling wedge pattern — a bullish formation marked by two converging downward trendlines. This breakout signals renewed momentum, further confirmed by Pi climbing above the 50-period Exponential Moving Average and surpassing the Woodie pivot point.

However, this upward momentum is now being overshadowed by potential warning signs. The coin appears to be forming a rising wedge pattern, a well-known bearish signal that occurs when price trends upward within converging lines. This formation is being reinforced by a bearish divergence in technical indicators. The Percentage Price Oscillator is nearing a bearish crossover, while the Relative Strength Index is starting to drift lower — both suggesting weakening momentum.

As a result, Pi Network may be heading toward a significant correction. If the trend reverses, the price could fall back to the critical support level of $0.3979 — nearly 47% below its current position. Nevertheless, there’s still a chance for the bullish outlook to persist. If Pi manages to break through the immediate resistance at $0.8610, as indicated by the Woodie pivot point, it could aim for the psychologically important $1 mark, representing a potential 32% increase from today’s levels.

Leave a Reply