Ripple Set to Unveil Expanded XRP Markets Report as Institutional Demand Soars – What’s Coming Next?

Ripple is set to retire its current quarterly XRP Markets report format after Q2 2025, introducing new versions that will offer deeper insights into XRP’s growing institutional usage. This shift comes as Ripple recognizes the increasing demand from institutional investors, prompting a need for more detailed market data. The decision follows Ripple’s admission in its Q1 2025 report that the current format hasn’t had the intended impact, with the company’s transparency often being used against it, particularly by former SEC leadership. As institutional interest in XRP continues to rise, the revamped reports will include enhanced perspectives to better reflect the evolving market dynamics.

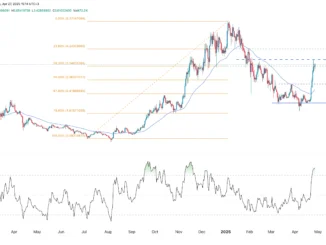

The Q1 2025 report also highlighted XRP’s impressive performance, with the token surging nearly 50% in February, outpacing Bitcoin and Ethereum amid market turbulence. XRP’s relative strength was underscored by a 10% rise in its ratio against BTC. Institutional interest was evident, with \$37.7 million in net inflows into XRP-based investment products, bringing the year-to-date total to \$214 million. This surge in interest also mirrored strong spot market activity, with average daily volumes around \$3.2 billion, and a sharp spike in price volatility during the quarter. Despite some slowdown in on-chain activity, XRP’s decentralized finance sector showed resilience, particularly through RLUSD, which surpassed a \$90 million market cap.