Crypto on the Edge: Pi Network, XRP, and Sui Set to Shake the Market This Week

Cryptocurrency prices saw a significant rally last week, with Bitcoin breaking the $95,000 mark for the first time in over a month. This surge, alongside Solana meme coins reaching a $10 billion market cap, set the stage for key cryptos like Pi Network, XRP, and Sui to dominate the spotlight this week.

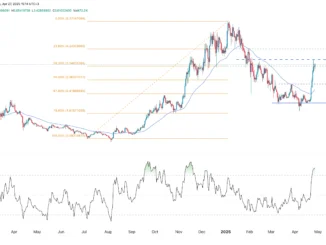

Sui, a leading layer-1 blockchain, saw its price surge to $3.80, driven by a rise in meme coin activity and a 60% increase in weekly DEX volume. However, a scheduled token unlock worth $120 million on Thursday could disrupt its momentum. Similarly, XRP is at a pivotal level, trading near its 50-day Exponential Moving Average, with the price needing to break a descending trendline to avoid a bearish outlook. Pi Network, currently in a phase of consolidation, could experience a breakout if it gets listed on a major exchange, such as HTX, fueling speculation about a major price jump.